Carbon credits represent a tradable permit that allows the holder to emit a specific amount of carbon dioxide, typically one ton, supporting regulatory compliance in emissions reduction. Carbon offsets involve projects that actively reduce or remove greenhouse gases from the atmosphere, such as reforestation or renewable energy initiatives, which individuals and companies can purchase to compensate for their own emissions. Both tools drive sustainability efforts, but carbon credits are primarily market-driven regulatory mechanisms, whereas carbon offsets emphasize voluntary carbon neutrality and environmental impact.

Table of Comparison

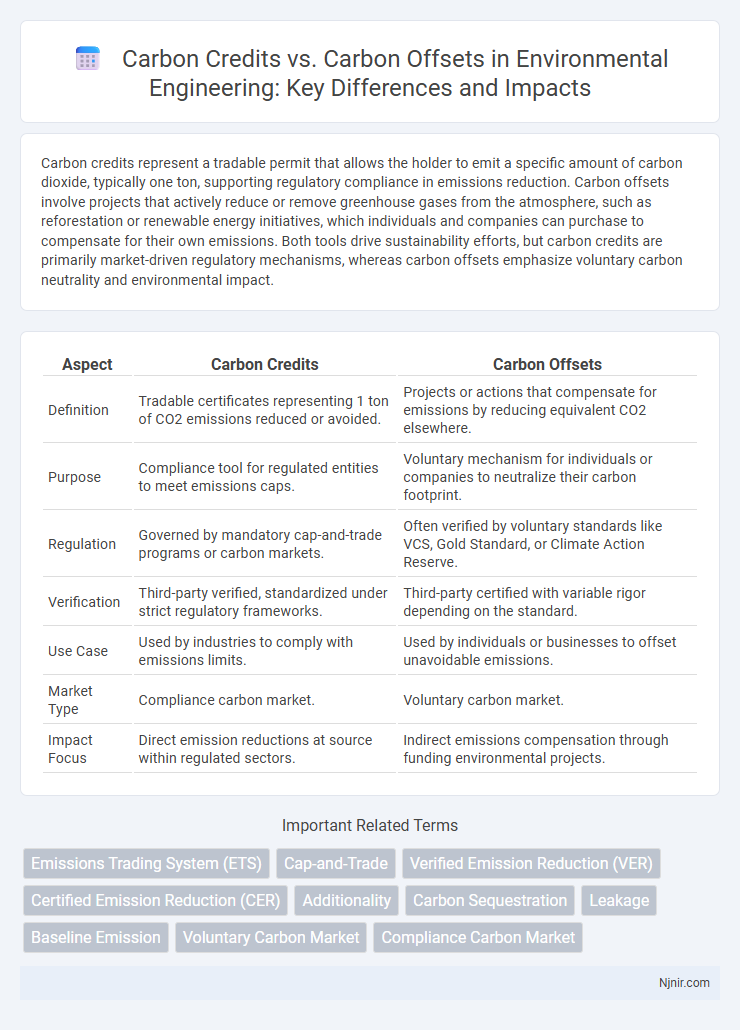

| Aspect | Carbon Credits | Carbon Offsets |

|---|---|---|

| Definition | Tradable certificates representing 1 ton of CO2 emissions reduced or avoided. | Projects or actions that compensate for emissions by reducing equivalent CO2 elsewhere. |

| Purpose | Compliance tool for regulated entities to meet emissions caps. | Voluntary mechanism for individuals or companies to neutralize their carbon footprint. |

| Regulation | Governed by mandatory cap-and-trade programs or carbon markets. | Often verified by voluntary standards like VCS, Gold Standard, or Climate Action Reserve. |

| Verification | Third-party verified, standardized under strict regulatory frameworks. | Third-party certified with variable rigor depending on the standard. |

| Use Case | Used by industries to comply with emissions limits. | Used by individuals or businesses to offset unavoidable emissions. |

| Market Type | Compliance carbon market. | Voluntary carbon market. |

| Impact Focus | Direct emission reductions at source within regulated sectors. | Indirect emissions compensation through funding environmental projects. |

Understanding Carbon Credits and Carbon Offsets

Carbon credits represent a tradable permit allowing the holder to emit one metric ton of carbon dioxide or equivalent greenhouse gases, enabling companies to meet regulatory emission limits. Carbon offsets, on the other hand, are investment mechanisms that fund projects reducing or capturing emissions outside the buyer's direct operations, such as reforestation or renewable energy initiatives. Understanding the distinction highlights how carbon credits focus on compliance within emission caps, while offsets emphasize voluntary emission reductions or compensation.

Key Differences Between Carbon Credits and Offsets

Carbon credits represent a tradable permit allowing the holder to emit a specific amount of carbon dioxide, typically one metric ton, within capped emission limits, serving as a market-based regulatory tool. Carbon offsets involve projects or actions that directly reduce, avoid, or capture emissions elsewhere, such as reforestation or renewable energy initiatives, used primarily for voluntary or compliance-based emission compensation. The key difference lies in carbon credits enabling emissions within legal frameworks through trading, while carbon offsets focus on neutralizing existing emissions by supporting measurable environmental projects.

How Carbon Credits Work in Environmental Policy

Carbon credits function as tradable permits allowing organizations to emit a specific amount of greenhouse gases, creating a market-driven approach to limit overall emissions. Governments or regulatory bodies allocate these credits, and companies that reduce their emissions below their quota can sell excess credits to those exceeding limits. This system incentivizes industrial emissions reduction by assigning economic value to carbon limits, directly supporting national and international climate targets.

The Mechanics of Carbon Offsets in Practice

Carbon offsets involve funding projects that actively reduce or remove greenhouse gas emissions, such as reforestation or renewable energy installations, effectively compensating for emissions produced elsewhere. These offsets are quantified in metric tons of CO2-equivalent reduced or captured, validated through standards like the Verified Carbon Standard (VCS) or the Gold Standard to ensure credibility and environmental integrity. In practice, organizations purchase these verified offsets to balance out their carbon footprint, supporting measurable and verifiable environmental projects to meet sustainability goals.

Economic Impacts of Carbon Credits vs. Offsets

Carbon credits create market-driven economic incentives for companies to reduce greenhouse gas emissions by allowing them to trade emission allowances, fostering innovation in clean technologies and generating revenue streams. In contrast, carbon offsets primarily serve as a compensatory mechanism where organizations invest in external projects like reforestation or renewable energy to neutralize their emissions, often with limited direct impact on their core operations. The economic impact of carbon credits is typically more significant due to their role in shaping corporate behavior and influencing broader market regulations.

Environmental Benefits: Credits vs. Offsets

Carbon credits represent verified reductions in greenhouse gas emissions that can be traded in regulated markets, directly incentivizing businesses to lower their carbon footprint. Carbon offsets fund projects that reduce or remove emissions, such as reforestation or renewable energy, compensating for emissions produced elsewhere. Both mechanisms contribute to environmental sustainability, but carbon credits drive systemic emission reductions, while offsets primarily support localized environmental benefits and community development.

Challenges and Criticisms of Carbon Trading Systems

Carbon trading systems face challenges such as market volatility, regulatory complexities, and limited verification standards, undermining the reliability of carbon credits and offsets. Critics argue that carbon offsets often enable businesses to delay genuine emissions reductions by purchasing credits rather than investing in sustainable practices. Furthermore, issues like double counting, lack of transparency, and inadequate monitoring compromise the environmental integrity of carbon markets, limiting their effectiveness in combating climate change.

Regulatory Frameworks Governing Credits and Offsets

Carbon credits are regulated under cap-and-trade systems established by governments, such as the European Union Emissions Trading System (EU ETS), which set mandatory limits on greenhouse gas emissions. Carbon offsets, however, often fall under voluntary market standards like the Verified Carbon Standard (VCS) or the Gold Standard, which certify emission reduction projects outside regulatory mandates. Regulatory frameworks ensure carbon credits have legally binding compliance roles, whereas offsets primarily serve corporate social responsibility and voluntary environmental goals.

Role of Carbon Credits and Offsets in Achieving Net-Zero Goals

Carbon credits represent quantified emission reductions or removals verified by regulatory standards, allowing companies to comply with emission caps and drive investment in low-carbon technologies. Carbon offsets enable individuals and organizations to balance their unavoidable emissions by funding projects that reduce or capture greenhouse gases, such as reforestation or renewable energy initiatives. Both carbon credits and offsets play critical roles in achieving net-zero goals by facilitating emission accountability, promoting sustainable investments, and accelerating the transition to a low-carbon economy.

Future Trends in Carbon Credit and Offset Markets

The future trends in carbon credit and offset markets emphasize increased integration of blockchain technology for transparency and traceability, driving higher investor confidence and regulatory compliance. Market expansion is projected as more countries implement stricter carbon pricing mechanisms, fostering demand for both credits and offsets in hard-to-abate sectors like aviation and heavy industry. Advances in satellite monitoring and AI-driven analytics will enhance verification accuracy, reducing fraud and promoting more reliable carbon reduction outcomes.

Emissions Trading System (ETS)

The Emissions Trading System (ETS) primarily utilizes carbon credits to cap and reduce greenhouse gas emissions by allowing companies to trade emission allowances, whereas carbon offsets represent projects that compensate for emissions outside the regulated market.

Cap-and-Trade

Cap-and-trade systems regulate carbon emissions by setting a cap on total emissions and allowing companies to trade carbon credits, which differs from carbon offsets that represent reductions outside the capped system.

Verified Emission Reduction (VER)

Verified Emission Reductions (VERs) are a type of carbon offset representing certified reductions in greenhouse gas emissions used to compensate for emissions elsewhere, while carbon credits are tradable permits allowing holders to emit a certain amount of carbon dioxide.

Certified Emission Reduction (CER)

Certified Emission Reduction (CER) credits, issued under the Clean Development Mechanism, represent verified carbon credits used by companies to comply with carbon reduction regulations, whereas carbon offsets broadly include voluntary projects that compensate for emissions through various environmental initiatives.

Additionality

Carbon credits ensure additionality by representing verified emission reductions from projects that would not have occurred otherwise, whereas carbon offsets may lack rigorous additionality, sometimes funding activities that would have happened without the offset purchase.

Carbon Sequestration

Carbon credits represent measurable reductions in greenhouse gas emissions verified by regulatory standards, while carbon offsets specifically fund carbon sequestration projects that capture and store atmospheric CO2 to mitigate climate change.

Leakage

Carbon offsets often face leakage issues, where emission reductions in one area cause an increase elsewhere, while carbon credits are regulated to minimize such displacement effects.

Baseline Emission

Baseline emissions serve as the reference point for calculating carbon credits by measuring actual reductions, while carbon offsets represent compensatory actions that counterbalance emissions beyond the established baseline.

Voluntary Carbon Market

Voluntary Carbon Markets enable businesses to purchase carbon offsets, which represent verified emission reductions, while carbon credits are regulated permits within compliance markets allowing emission allowances trading.

Compliance Carbon Market

Compliance Carbon Market relies on mandatory carbon credits regulated by authorities, whereas carbon offsets are typically voluntary reductions used to supplement compliance or corporate sustainability goals.

carbon credits vs carbon offsets Infographic

njnir.com

njnir.com