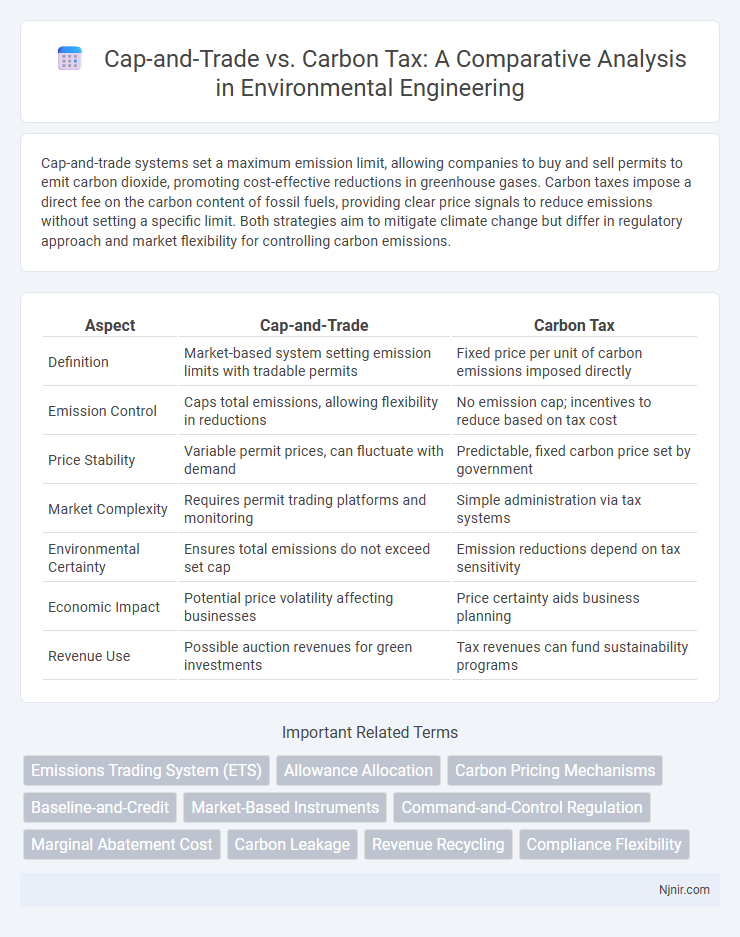

Cap-and-trade systems set a maximum emission limit, allowing companies to buy and sell permits to emit carbon dioxide, promoting cost-effective reductions in greenhouse gases. Carbon taxes impose a direct fee on the carbon content of fossil fuels, providing clear price signals to reduce emissions without setting a specific limit. Both strategies aim to mitigate climate change but differ in regulatory approach and market flexibility for controlling carbon emissions.

Table of Comparison

| Aspect | Cap-and-Trade | Carbon Tax |

|---|---|---|

| Definition | Market-based system setting emission limits with tradable permits | Fixed price per unit of carbon emissions imposed directly |

| Emission Control | Caps total emissions, allowing flexibility in reductions | No emission cap; incentives to reduce based on tax cost |

| Price Stability | Variable permit prices, can fluctuate with demand | Predictable, fixed carbon price set by government |

| Market Complexity | Requires permit trading platforms and monitoring | Simple administration via tax systems |

| Environmental Certainty | Ensures total emissions do not exceed set cap | Emission reductions depend on tax sensitivity |

| Economic Impact | Potential price volatility affecting businesses | Price certainty aids business planning |

| Revenue Use | Possible auction revenues for green investments | Tax revenues can fund sustainability programs |

Introduction to Carbon Pricing Mechanisms

Carbon pricing mechanisms are market-based strategies designed to reduce greenhouse gas emissions by assigning a cost to carbon output. Cap-and-trade sets a maximum emission limit and allows companies to trade emission permits, creating economic incentives for cutting pollution. Carbon tax directly imposes a fixed fee per ton of emitted CO2, offering predictability in carbon costs and encouraging businesses to innovate toward cleaner technologies.

Understanding Cap-and-Trade Systems

Cap-and-trade systems set a maximum limit on greenhouse gas emissions, allowing companies to buy and sell emission allowances to meet their targets efficiently. This market-based approach incentivizes reductions where they are cheapest and fosters innovation in low-carbon technologies. By capping total emissions, it guarantees environmental outcomes while providing economic flexibility compared to a fixed carbon tax.

Overview of Carbon Tax Policies

Carbon tax policies impose a fixed price per ton of carbon dioxide emitted, providing a clear financial incentive for businesses and individuals to reduce greenhouse gas emissions. These taxes encourage innovation in low-carbon technologies and energy efficiency by making carbon-intensive activities more expensive. Many countries, including Sweden, Canada, and Japan, have implemented carbon taxes as part of their climate change strategies to meet emission reduction targets effectively.

Environmental Effectiveness: Comparing Outcomes

Cap-and-trade systems set a clear limit on total greenhouse gas emissions, ensuring a direct environmental benefit by capping pollution levels. Carbon taxes provide a consistent price signal that encourages emission reductions through economic incentives but do not guarantee specific emission targets. Studies indicate cap-and-trade often achieves more precise emissions cuts, while carbon taxes offer simpler implementation and price stability, impacting overall environmental effectiveness differently.

Economic Impacts of Cap-and-Trade vs Carbon Tax

Cap-and-trade systems create a market for emission permits, encouraging companies to innovate and reduce emissions cost-effectively while providing certainty about overall emission limits. Carbon taxes set a fixed price on carbon, offering predictable costs for businesses but uncertain emission reductions depending on market response. Economic impacts of cap-and-trade include potential price volatility and administrative complexity, whereas carbon taxes provide fiscal revenue stability and simpler implementation but may face political resistance due to visible cost increases.

Administrative Complexity and Implementation

Cap-and-trade systems require establishing a robust regulatory framework for issuing allowances, monitoring emissions, and enforcing compliance, resulting in moderate administrative complexity. Carbon taxes demand clear legislation on tax rates and reporting mechanisms but tend to be simpler to administer due to straightforward tax collection processes. Implementation of cap-and-trade can be slower due to the need for market infrastructure and continuous oversight, whereas carbon taxes offer faster deployment with predictable revenue streams and easier integration into existing tax systems.

Flexibility and Market Dynamics

Cap-and-trade systems offer flexibility by allowing businesses to buy and sell emission permits, creating a market-driven price for carbon that adjusts based on supply and demand. Carbon taxes provide price certainty by setting a fixed cost per ton of emissions but lack the ability to guarantee specific emissions reductions or adapt dynamically to market fluctuations. The market dynamics in cap-and-trade encourage innovation and cost-effective pollution control, while carbon taxes create predictable incentives for emission reduction without the same level of trading flexibility.

Revenue Generation and Utilization

Cap-and-trade systems generate revenue by auctioning emission permits, allowing governments to allocate funds towards renewable energy projects and climate adaptation programs. Carbon taxes provide a predictable revenue stream based on emissions levels, which can be utilized for technology innovation, public transportation infrastructure, or tax rebates to offset economic impacts. Both mechanisms incentivize emission reductions while offering flexible financial tools for sustainable development and environmental policy goals.

Global Case Studies and Lessons Learned

Cap-and-trade systems, exemplified by the European Union Emissions Trading System (EU ETS), demonstrate how market-based mechanisms can effectively limit greenhouse gas emissions by setting a firm emissions cap while allowing trading of allowances. Carbon tax implementations, such as Sweden's tax introduced in 1991, highlight the impact of fixed price signals on reducing carbon output and encouraging renewable energy adoption. Lessons from these global case studies emphasize the importance of clear regulatory frameworks, price stability, and monitoring to ensure environmental effectiveness and economic efficiency in carbon pricing strategies.

Future Outlook: Integrating Carbon Pricing in Climate Policy

Cap-and-trade systems offer flexibility by setting a hard limit on emissions while allowing market-driven trading of allowances to achieve cost-effective reductions. Carbon taxes provide price certainty, incentivizing steady emissions cuts by assigning a clear cost to carbon output, facilitating predictable investment decisions. Future climate policy increasingly favors hybrid approaches combining cap-and-trade's environmental certainty with carbon tax stability to optimize emissions control and economic resilience.

Emissions Trading System (ETS)

The Emissions Trading System (ETS) under cap-and-trade sets a firm limit on carbon emissions while allowing market-based trading of allowances to efficiently reduce greenhouse gases.

Allowance Allocation

Allowance allocation in cap-and-trade systems involves distributing emission permits either for free or auction, directly impacting market efficiency and equity, whereas carbon tax systems do not require allowance allocation as they impose a fixed price on emissions.

Carbon Pricing Mechanisms

Carbon pricing mechanisms include cap-and-trade systems, which set emission limits and allow trading of allowances, and carbon taxes, which impose a fixed price per ton of emitted CO2 to incentivize reductions.

Baseline-and-Credit

Baseline-and-credit systems in cap-and-trade set emission baselines for entities, awarding credits for reductions below the baseline, unlike fixed carbon taxes that impose a consistent price per ton of CO2 emitted.

Market-Based Instruments

Cap-and-trade and carbon tax are market-based instruments that incentivize emission reductions by either setting a pollution limit with tradable permits or imposing a fixed price on carbon emissions.

Command-and-Control Regulation

Command-and-Control Regulation mandates specific emission limits or technologies, contrasting with Cap-and-trade's market-based emissions trading and Carbon tax's fixed price on carbon output.

Marginal Abatement Cost

Cap-and-trade systems provide flexibility by allowing firms to buy and sell emission permits, often leading to a lower marginal abatement cost compared to a fixed carbon tax that sets a uniform price but can result in variable abatement levels across firms.

Carbon Leakage

Carbon tax risks higher carbon leakage due to fixed costs on emissions, whereas cap-and-trade systems can more dynamically limit leakage by capping total emissions and enabling tradeable allowances.

Revenue Recycling

Cap-and-trade systems generate variable revenue through auctioned permits, which can be recycled into renewable energy investments, while carbon taxes provide predictable revenue streams that policymakers can redistribute as rebates or fund green initiatives.

Compliance Flexibility

Cap-and-trade systems offer greater compliance flexibility by allowing businesses to buy and sell emission allowances, whereas carbon taxes provide fixed pricing but limited adaptability in meeting reduction targets.

Cap-and-trade vs Carbon tax Infographic

njnir.com

njnir.com