Direct labor refers to the workforce directly involved in manufacturing products, where their hours are easily traceable to specific units of output. Indirect labor includes employees who support production processes but do not work directly on the product, such as maintenance and supervision staff. Efficient management of both labor types is essential for optimizing production costs and enhancing overall operational efficiency.

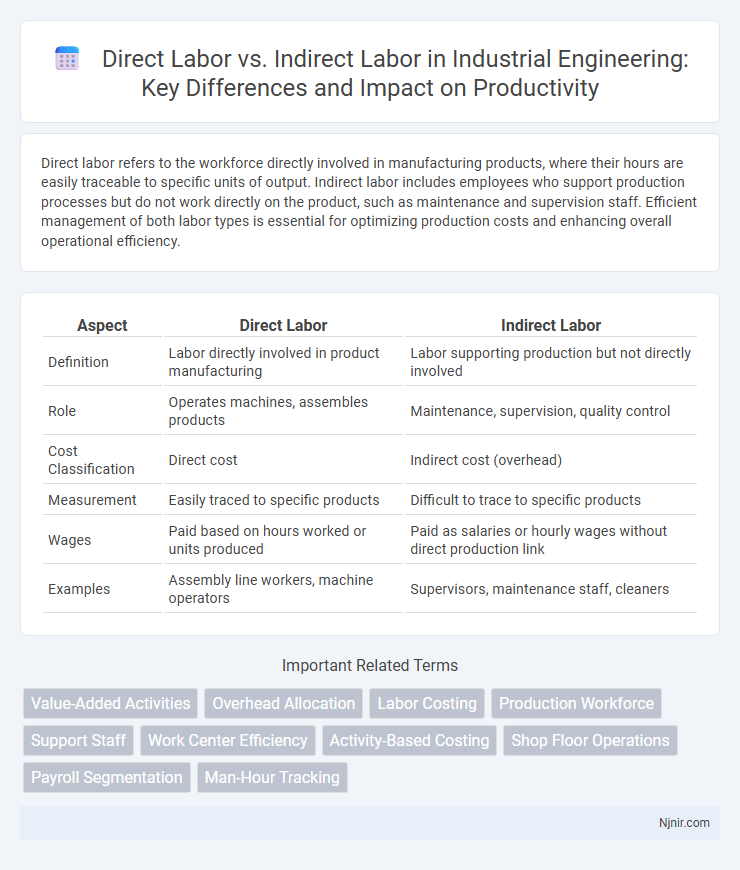

Table of Comparison

| Aspect | Direct Labor | Indirect Labor |

|---|---|---|

| Definition | Labor directly involved in product manufacturing | Labor supporting production but not directly involved |

| Role | Operates machines, assembles products | Maintenance, supervision, quality control |

| Cost Classification | Direct cost | Indirect cost (overhead) |

| Measurement | Easily traced to specific products | Difficult to trace to specific products |

| Wages | Paid based on hours worked or units produced | Paid as salaries or hourly wages without direct production link |

| Examples | Assembly line workers, machine operators | Supervisors, maintenance staff, cleaners |

Introduction to Direct and Indirect Labor

Direct labor consists of employees who are directly involved in the production of goods or services, such as assembly line workers, machine operators, and craftsmen. Indirect labor includes workers who support the production process without directly handling the product, such as supervisors, maintenance staff, and quality control inspectors. Differentiating direct and indirect labor is essential for accurate cost allocation and financial analysis in manufacturing and service industries.

Defining Direct Labor in Industrial Engineering

Direct labor in industrial engineering refers to the workforce directly involved in producing goods or services, such as machine operators and assembly line workers, whose hours and efforts can be clearly traced to specific products. This type of labor is measurable and directly linked to manufacturing costs, impacting product pricing and efficiency analyses. Unlike indirect labor, which supports production without direct product involvement, direct labor is essential for calculating accurate job costing and optimizing production workflows.

Understanding Indirect Labor Roles

Indirect labor refers to employees who support the production process without directly working on the product, such as maintenance staff, supervisors, and quality control inspectors. These roles are essential for ensuring smooth operations, equipment upkeep, and adherence to safety standards, which ultimately enhance overall productivity. Unlike direct labor, indirect labor costs are classified as overhead and allocated across various projects or departments to accurately reflect manufacturing expenses.

Key Differences Between Direct and Indirect Labor

Direct labor involves employees who actively participate in the production process, directly contributing to the manufacturing of goods or services, such as assembly line workers. Indirect labor includes employees who support production but do not directly engage in creating the product, like maintenance staff and supervisors. The key differences lie in cost allocation, where direct labor is charged to production costs while indirect labor is treated as overhead or operating expenses.

Examples of Direct and Indirect Labor in Manufacturing

Direct labor in manufacturing includes workers who physically assemble products, operate machinery on the production line, or perform tasks directly tied to product creation, such as welders, machine operators, and assembly line workers. Indirect labor encompasses roles that support production but do not directly create the product, like maintenance technicians, quality control inspectors, supervisors, and janitorial staff. Understanding these distinctions helps accurately allocate labor costs in manufacturing operations for budgeting and cost control.

Cost Allocation: Direct vs Indirect Labor Costs

Direct labor costs are directly traceable to the production of specific goods or services, making them essential for accurate product costing and pricing strategies. Indirect labor costs, including supervision and maintenance wages, are allocated across multiple departments or products as overhead, requiring allocation methods such as activity-based costing for precise distribution. Effective cost allocation of direct and indirect labor enhances budgeting accuracy, improves profit margin analysis, and supports strategic decision-making in manufacturing and service industries.

Impact on Productivity and Efficiency

Direct labor directly contributes to the production process by performing tasks that create tangible products, significantly enhancing productivity through focused workforce allocation. Indirect labor supports these activities by maintaining equipment, managing workflows, and providing supervision, which optimizes overall efficiency but does not directly increase output volume. Balancing direct and indirect labor costs is crucial for maximizing operational efficiency and achieving sustainable productivity gains in manufacturing environments.

Challenges in Managing Direct and Indirect Labor

Managing direct labor requires precise scheduling and real-time monitoring to maintain productivity and control labor costs linked to specific products or services, while indirect labor challenges often involve tracking employees whose work supports operations without direct production input. Ensuring accurate allocation of wages and benefits between direct and indirect labor is critical to financial reporting and cost management but can be complicated by overlapping roles and fluctuating work demands. Effective labor management systems must integrate time-tracking, job costing, and flexible workforce management to address these issues and optimize operational efficiency.

Strategies for Optimizing Labor Utilization

Direct labor involves employees who actively contribute to product creation, while indirect labor supports production through maintenance, supervision, and administration. Strategies for optimizing labor utilization include implementing time-tracking systems to accurately allocate labor hours, cross-training employees to enhance flexibility, and analyzing labor cost data to identify inefficiencies. Leveraging technology and labor management software improves scheduling precision and drives productivity in both direct and indirect labor segments.

Conclusion: Balancing Direct and Indirect Labor in Industrial Operations

Balancing direct and indirect labor is crucial for optimizing industrial operations and maintaining cost efficiency. Direct labor directly impacts product output and quality, while indirect labor supports essential activities like maintenance, supervision, and administration that ensure smooth production flows. Effective management integrates both labor types to enhance productivity, reduce waste, and improve overall operational performance.

Value-Added Activities

Direct labor involves employees who perform value-added activities directly contributing to product creation, while indirect labor supports operations without directly adding value to the final product.

Overhead Allocation

Indirect labor costs are allocated as part of overhead expenses, while direct labor costs are charged directly to specific production jobs, making accurate overhead allocation essential for precise product costing.

Labor Costing

Direct labor costs are expenses directly attributed to production workers involved in manufacturing, while indirect labor costs cover support staff wages essential for operations but not directly tied to production.

Production Workforce

Direct labor in production workforce refers to employees actively involved in manufacturing products, while indirect labor includes support staff who do not directly handle production tasks.

Support Staff

Support staff form the core of indirect labor by providing essential services that enable direct labor employees to complete production tasks efficiently.

Work Center Efficiency

Direct labor directly impacts Work Center Efficiency by measuring productive hours spent on manufacturing, while indirect labor supports operations without directly contributing to output.

Activity-Based Costing

Activity-Based Costing distinguishes direct labor, which is easily traceable to specific products, from indirect labor, which supports multiple activities and is allocated based on cost drivers to improve accuracy in cost measurement.

Shop Floor Operations

Direct labor on the shop floor involves workers directly assembling or producing products, while indirect labor includes support staff like supervisors and maintenance personnel who facilitate production without directly handling materials.

Payroll Segmentation

Payroll segmentation distinctly categorizes direct labor costs tied to production activities and indirect labor expenses associated with support functions, optimizing cost allocation and financial reporting.

Man-Hour Tracking

Man-hour tracking differentiates direct labor, measured by hours spent on production tasks, from indirect labor, which involves non-production activities supporting operations.

Direct Labor vs Indirect Labor Infographic

njnir.com

njnir.com